Occupancy Data Shows APAC is Leading the Way With 214% Growth in Workplace Utilization

VergeSense is the industry leader in providing enterprises with a true understanding of their occupancy and how their offices are actually being used.

Today, we’re excited to share our first-ever regional study on 2022 workplace utilization trends, specifically looking at utilization across the US, APAC, and EMEA.

Many workplace leaders feel a sense of uncertainty as they monitor volatile workplace occupancy across their corporate portfolios.

To help your business understand how workplace occupancy is shifting and the upcoming trends you can expect, VergeSense analyzed occupancy data across 814 buildings globally, which includes 226 companies and over 150,000 spaces.

Here are the key findings from this report:

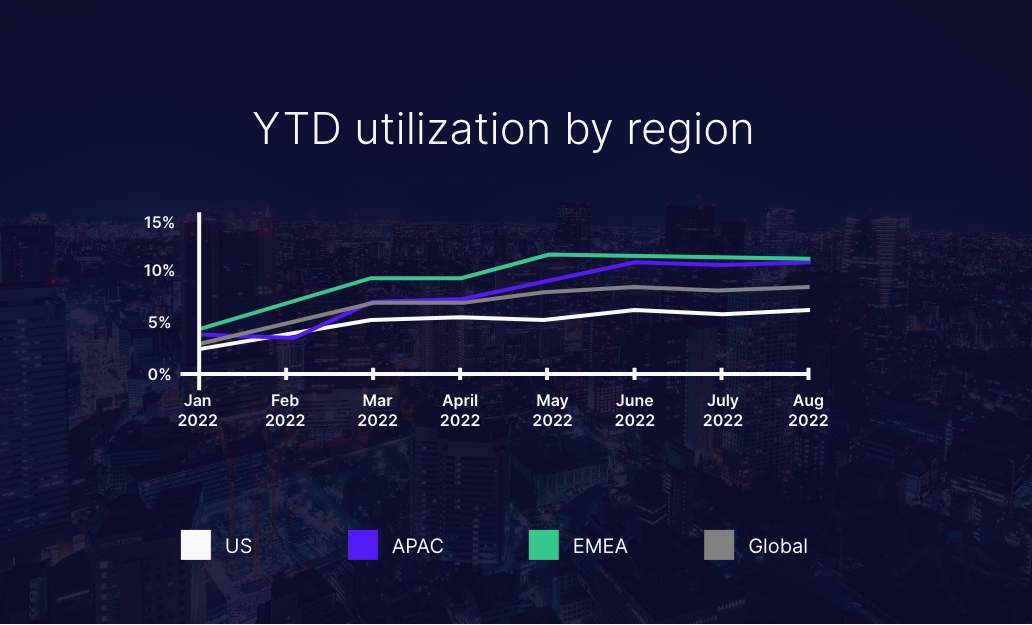

#1: In 2022, the utilization of office spaces globally has increased by 200%.

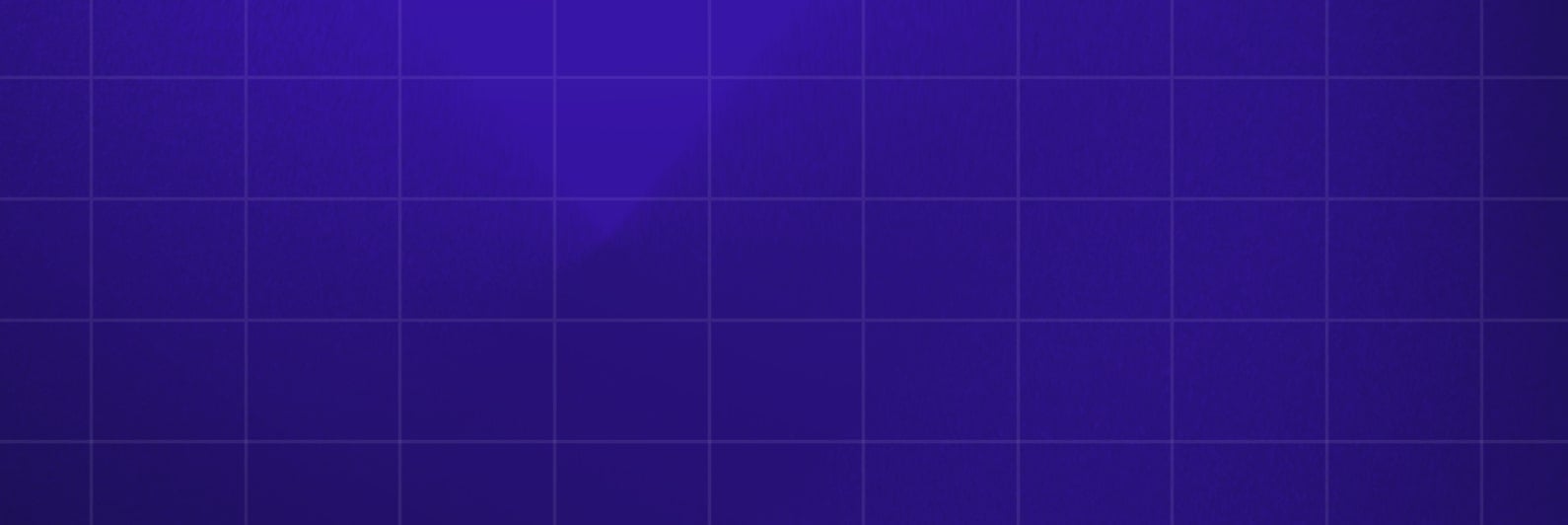

This increase in workplace utilization indicates that employees are returning to the office steadily, however at different rates of return. APAC is leading the pack with the fastest overall utilization growth rate in 2022. When looking at average utilization overall, EMEA and APAC are quite close with EMEA at 12% utilization and APAC at 11%, with the US below the global average at 6%.

Despite a slight slowdown during the summer months, it’s fair to assume that office utilization will resume a similar growth as we saw toward the beginning of the year.

#2: Utilization in EMEA and APAC has grown 11% faster than in the US.

Since January 2022, the space utilization in EMEA has increased by 207%, and that in APAC has increased by 214%.

So, why are countries in these regions leading in the return to office while the US is lagging behind?

One of the most common reasons that deter employees from coming into the office is their commute. Today, the average one-way commute time in the US is 28 minutes, and has only increased in recent years.

The US is a massive country with severely underfunded and underdeveloped networks of public transit. Some major cities have good transit networks, but there are few examples of areas with public transit systems that stretch well outside of the city.

This leaves the vast majority of the American population, even many within major cities, to rely on their cars to get to work. Not only is driving generally expensive, including car maintenance and insurance payments, but with gas costing an average of $4.495 a gallon, people across the US have realized they’re losing money by coming into the office.

So why would they if they can easily do their job well from home?

By contrast, many European countries have robust rail systems that work within cities and outside of them, making it easy, affordable, and environmentally friendly for employees to go into the city to their offices.

#3: The US has experienced the slowest growth in office space utilization in 2022

This year, office utilization in the US has increased by 186%. Although this number shows a definitive upward trend in office space use, it is important to note that it falls below the global average, and significantly behind countries in the EMEA and APAC regions.

Moreover, as of August 2022, EMEA and APAC are leading in workplace utilization metrics, with 26% greater utilization than the global average. The US is falling behind, with workplace utilization at 27% below the global average.

Why is space utilization increasing at a slower rate in the US?

Although this answer is complex, when looking back at the rise of hybrid work in the past few years, one of the main catalysts for remote work was the COVID-19 pandemic.

Public health was at top of mind when creating return to office policies, and the US was among the slowest regions to return to the physical workplace, with the rise of Omicron and the Delta variant disincentivizing in-person work.

In EMEA and APAC however, the faster rate of vaccine adoption encouraged employees to get back to work. Some US companies put policies in place that required unvaccinated employees to continue working from home in order to prevent the spread of COVID in the office. Others at least required unvaccinated employees to take a COVID test every time they come into the office.

This deterred a significant portion of the population — the unvaccinated — from returning to the office, even just on a hybrid basis or occasionally for a team meeting.

In Europe, vaccines didn’t become available until several months later than in the US, but the uptake was quicker and more widespread. The vaccination rates in Europe vary significantly by country, but in general the rate is higher — 72.8% across all EU countries, with some much higher, like Spain (85.7%) and Denmark (82%). Because of this, fewer workplaces had to put vaccination policies in place, which removed that barrier from anyone returning to the office.

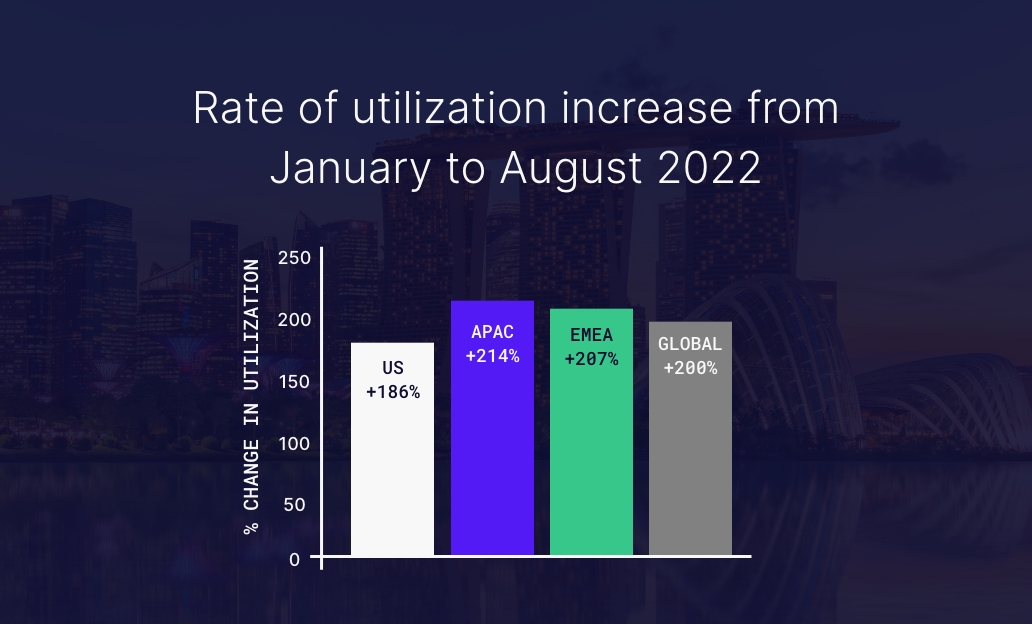

#4: In August 2022, utilization of collaborative spaces superseded that of individual spaces.

There has been a clear uptick in the utilization of collaborative spaces globally, with a 173% increase in use of these space types since January 2022. It’s important to note that this data is specifically looking at peak utilization, or max utilization across space types.

In fact, in August this year the peak utilization of collaborative spaces finally superseded the utilization of individual space types – such as private offices and individual desks. When looking at the data regionally, utilization of collaboration increased the most in APAC, with a 232% increase. In the US, the utilization of collaborative spaces has increased by 172% this year, which is notable yet not as fast as other regions given the country's overall slower rate of employee return.

This is evidence of a clear trend in collaboration in the workplace. Employees are coming into the office to collaborate and innovate with one-another, while completing their heads down tasks at home.

Ultimately, employees want to come into the office for experiences that they are unable to replicate from home or a coffee shop— the most impactful of these experiences is that of a company culture and community. With insight into which spaces are being used the most frequently, you can make workplace design decisions that fit the needs of your teams, and consequently, encourage them to come into the office.

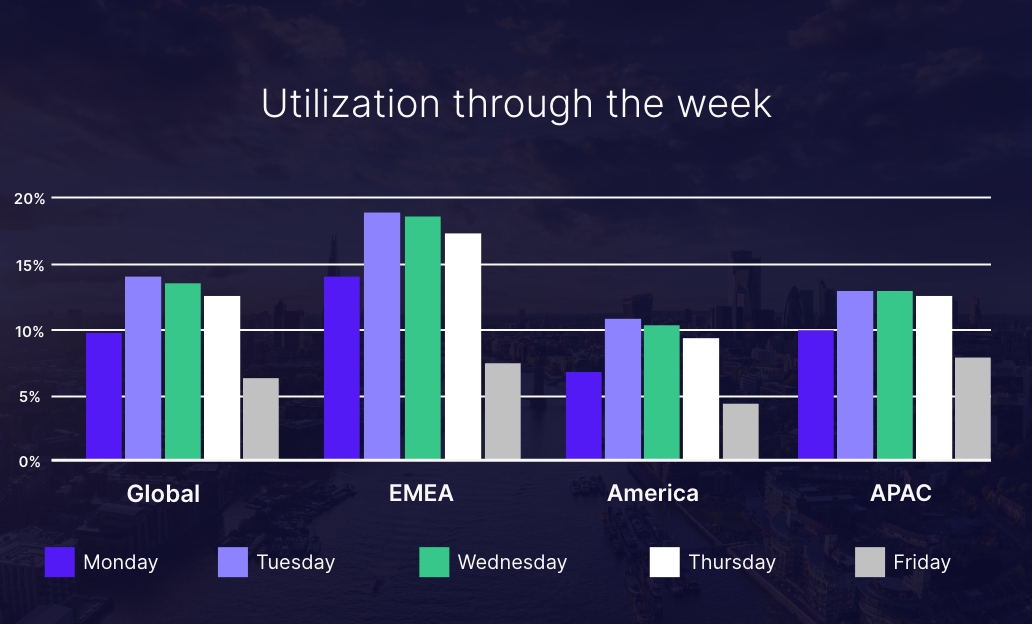

#5: Day of the week office attendance patterns are consistent across the world

More than 50% of weekly space utilization takes place on Tuesdays and Wednesdays, with the lowest workplace attendance on Fridays.

It’s likely unsurprising that the middle days of the week feature the highest office attendance. It’s not unusual for meetings to happen on those days, and thus employees are more inclined to come into the office so they can collaborate with their coworkers in person.

Having an understanding of your company’s most popular days at the office, as well as the space types that are experiencing the most demand on those days, is critical when creating a workplace strategy.

This helps with:

- Regulating unpredictable attendance

- Ensuring that there are enough amenities in place for employees when they do come into the office

Moreover, there’s an opportunity to leverage this data to optimize facilities operations. For days that are less busy, rather than having office operations running at capacity (HVAC systems), CRE leaders can plan in advance for which spaces will be used, and based on that information, pre-schedule room availability to prevent excessive operational costs. This is also a more sustainable approach to the workplace, which will enable your business to maintain ESG standards.

Adapting to the Changing Ways of Working Starts With Occupancy Intelligence

This data study indicates that the ways in which we work will continue to evolve. Today’s workplace is likely to be a hub for collaboration— across the world— as more and more employees are returning to the office to interact with each other.

The upward trend in utilization in the past year has revealed that employees are in the process of returning to the workplace. We will continue to monitor if collaboration is indeed their primary objective when they’re in the office, and if so how workplace leaders can better determine the necessary amount of individual workstations.

Moreover, the trends from the past few years have revealed that employees’ use of space is perpetually shifting and will continue to evolve. With this continued variability, it is imperative to have tools in place to monitor and measure office utilization and attendance. Without a true understanding of space use, enterprises make decisions based on assumptions, resulting in enormous unnecessary costs and a compromised employee experience.

Today over 130 global companies rely on VergeSense for a true understanding of how their workplaces are used, so they can continuously and confidently optimize spaces to reduce costs and improve employee experiences. Customers choose VergeSense to gain confidence, agility, and peace of mind.

VergeSense is the world’s first and only Occupancy Intelligence Platform. It is designed to give you a true understanding of how your spaces are being used, so you don’t have to compromise between reducing cost or improving employee experience.

As part of the Occupancy Intelligence Platform, VergeSense has released two new solutions:

-

Occupancy Intelligence for Portfolio Optimization: This solution allows real estate leaders to cut costs by correctly sizing for where they need more office space and where they need less.

-

Occupancy Intelligence for Space Optimization: This solution allows workplace and facilities leaders to create a frictionless experience by using real-time occupancy data to adapt their most valuable spaces with confidence.

With these insights, VergeSense customers can make better and faster decisions about how to optimize for cost savings and improved employee experience when adapting to changing workplace needs.

Customers like Deutsche Bank, Autodesk, and BP choose VergeSense to continuously and confidently optimize spaces to reduce costs and improve employee experience.

Ready to learn more about the VergeSense Occupancy Intelligence Platform? Request a demo with VergeSense today and unlock the latest workplace findings in the State of the Workplace Data Report.